|

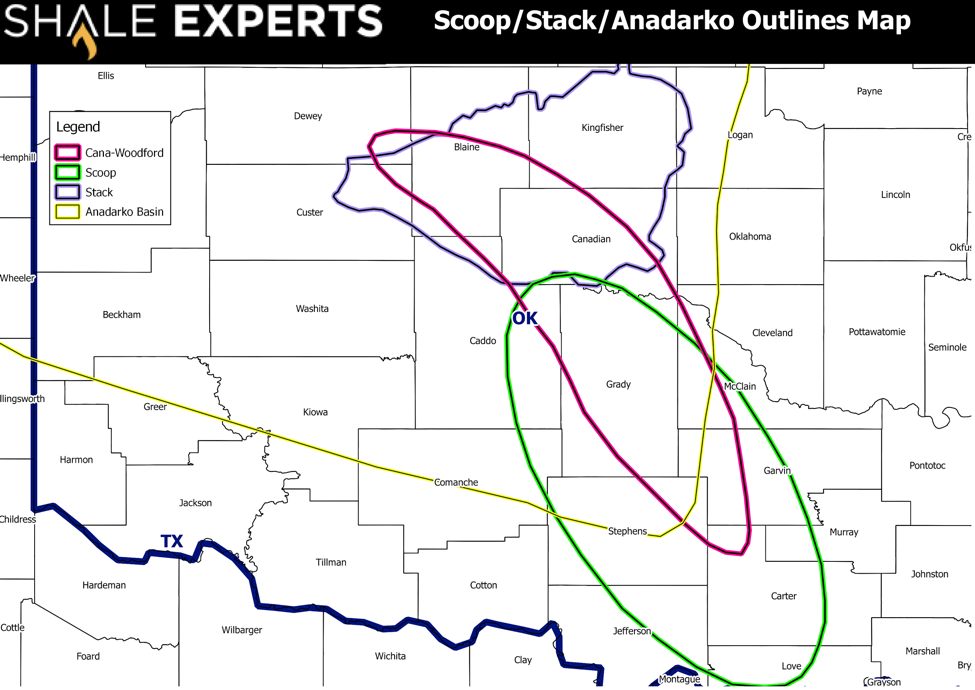

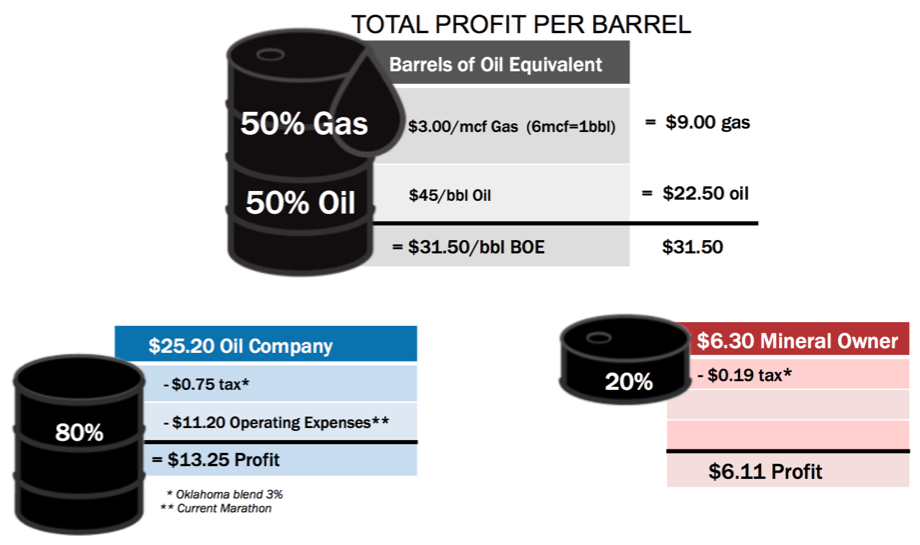

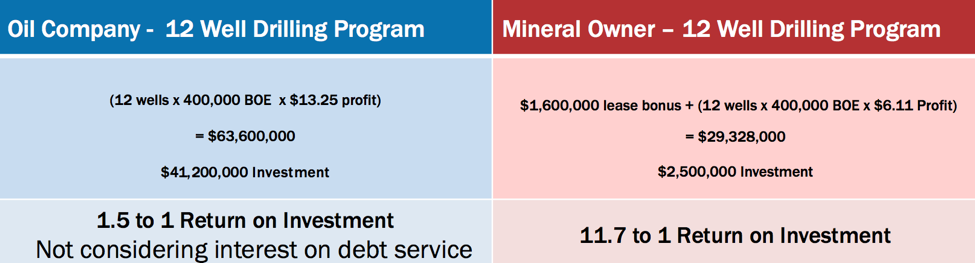

In a recent blog post, we discussed what mineral rights are. To recap, mineral rights, also known as mineral interests, are a form of real property rights. Owning mineral rights gives an individual the right to exploit, mine or produce any or all of the minerals lying below the surface of the property -- in this instance, oil and gas. Once you own mineral rights, they never expire. Now that we’ve established what constitutes ownership of mineral rights, let’s explore how to make money from them. Owning oil and gas minerals is different than participating in a drilling and development program. Owning mineral rights tends to have a lower risk profile and can have higher rewards than investing in a drilling program for several reasons, such as not having to contribute to operating expenses, completion or dry-hole costs. The mineral rights owner receives an up-front lump sum lease signing bonus from the drilling company paid on a per-acre basis for the right to drill. In addition to the lease bonus paid to the mineral rights owner, there’s also the off-the-top monthly percentage (12.5 percent to 25 percent) of gross production check that is owed to the mineral rights owner, often referred to as “Green Mail.” At Redhawk, we typically produce cash flow for investors within six to 12 months of beginning mineral purchases. Based on fairly conservative assumptions, estimated return targets in one of our mineral programs could create a mid-range internal rate of return (IRR) of almost 26 percent and a very handsome ROI. To further demonstrate how the process of investing in mineral rights works and to showcase the potential for profit, let’s look at an example using the STACK play (Sooner Trend Anadarko Basin, Canadian and Kingfisher counties) in Oklahoma. Some of the biggest independents are already drilling the area successfully, and many have committed to expansive drilling programs. For example, large operators with considerable activity are Devon with 430,000 acres and 5,300 locations, Newfield Exploration with 210,000 acres and 3,850 locations and Continental Resources with 146,000 acres, to name just a few. Source: ShaleExperts.com In the example below, with oil shown at $45.00 per barrel (bbl), the gross profit per barrel would be about $31.50 per boe (barrel of oil equivalent). For this example, let’s assume a production mix of 50 percent oil and 50 percent gas. After having paid a lump sum, upfront cash bonus, to the mineral rights owner, plus a promise to pay them the top 20 percent of revenue from production, the oil company would get 80 percent of the revenue, or $25.20 per bbl. From their gross profit, the oil company would then deduct $.75 per bbl for taxes and $11.20 per bbl for operating expenses, leaving a profit of $13.25 per bbl. The mineral owner, on the other hand, after “banking” the up-front lease bonus in advance, receives his 20 percent of the gross revenue or $6.30 per bbl. From that amount, the mineral owner deducts only the $0.19 per bbl tax (ad valorem tax only) for a per bbl profit of $6.11. The mineral owner has borne zero drilling risks, zero completion risks and has paid no operating expenses. The oil company has to invest very large sums of money to accomplish their return on investment goals which -- when compared to the mineral owner’s goals -- seem way out of proportion. The following chart will show what we mean. We have estimated there will be 12 wells per square mile (640 acres, or “section”) drilled by the large operators already drilling in the STACK. In some cases, with improving efficiencies, there may be as many as 17 wells per section drilled. It’s clear from the example given that investing in mineral rights is a smart decision that involves a low-risk investment with a potential for high-yield, in comparison to investing in a drilling operation. We pride ourselves on being transparent and on thoroughly educating our qualified and accredited investors. At Redhawk Investment Group, we have decades of experience developing and managing oil and gas investments. This fall, we’re offering accredited investors the opportunity to invest in our Redhawk Minerals Fund II, LP. This fund, with mineral rights strategically located in Oklahoma’s high-producing STACK play, is projected to be a 30 million dollar fund with an average annual yield target of 20+ percent. Are you curious to learn more about mineral rights and how you can make money from ownership? Get in touch with us today. The material herein does not constitute an offer to see nor is it a solicitation of an offer to purchase any security. Offers will only be made through a private placement memorandum to accredited investors and where permitted by law. Investments in security are not suitable for all investors who can withstand the loss of their investment. Investors should perform their own investigations before considering any investments and consult with their own legal and tax advisors. Past performance does not guarantee future results. This presentation is copyrighted material and only for the use by Redhawk Investment Group and its affiliates.

13 Comments

Bob Lempa

12/2/2017 08:02:06 am

Please contact me on mineral rights investments.

Reply

6/18/2018 11:05:25 am

Bob,

Reply

Rebecca Sodek

6/28/2018 10:31:06 am

Hi Bob,

Reply

Agfc

12/10/2017 09:46:25 am

Information

Reply

6/18/2018 11:08:23 am

Please contact my office via email at [email protected] or call direct at 972-684-5709. I will be happy to guide you and answer any questions you may have.

Reply

Rebecca Sodek

6/28/2018 10:32:02 am

Hi there! I wanted to make sure you received the information you requested. It can be found at https://www.redhawkinvestmentgroup.com/minerals2

Reply

Steven Smith

12/12/2017 07:16:53 am

Please, notify me for mineral rights

Reply

6/18/2018 11:10:52 am

Steven,

Reply

Rebecca Sodek

6/28/2018 10:33:27 am

Hi Steven,

Reply

Kitty Thaxton

1/7/2018 07:46:43 pm

Have several mineral rights some not under contract

Reply

Glen Wolfe

1/15/2018 07:47:26 pm

Interested in more information and the up front cost.

Reply

Glen,

Reply

6/18/2018 11:15:15 am

Glen,

Reply

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

October 2018

Click here to view our Offerings |

Hours: M - F 8:00 a.m. - 5:00 p.m. CentralTelephone: 214-624-9867Email: jnichols@peqtx.com |

Quotes by TradingView

|

Redhawk Investment Group, LLC offers direct and alternative oil and gas investment opportunities that enable investors to participate in the potential cash flow and the unique tax benefits associated with oil and gas investments. There are significant risks associated with investing in oil and gas offerings. The information contained in this website is for informational purposes only and is not a solicitation to buy or sell any securities. Information on this site is not intended to be used as investment or tax advice. Consult your investment advisor or tax advisor concerning the current tax laws and effects on your personal tax situation.