|

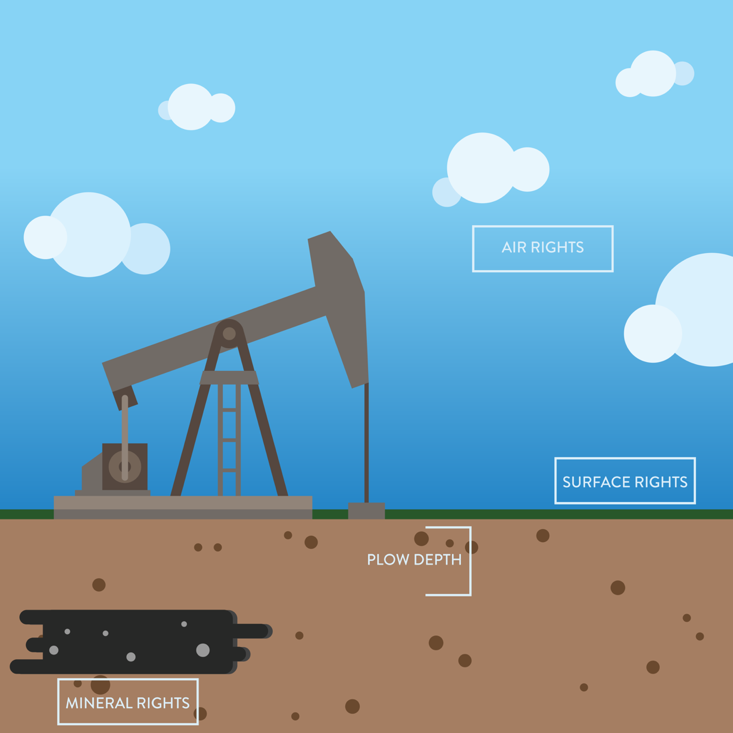

Most investors like the idea of big profits investing in oil and gas, but are averse to the financial risk of dry holes and oppressive operating expenses that eat up profits. If that sounds like you, then owning mineral rights certainly deserves some serious consideration. There are some HUGE profits to be made, but it is not a drilling or development deal, and it can truly be a legacy asset for generations if the owner so desires. (Click here for a Bloomberg article about mineral rights gushing cash). Mineral rights, also known as mineral interests, are a type of real property rights. Owning mineral rights gives an individual the ability to exploit, mine or produce any or all of the minerals lying below the surface of the property -- in this instance, oil and gas. Mineral rights ownership is comparatively scarce. The opportunity for private individuals to own mineral rights is available only in the United States and parts of Canada (only 11% of Canadian minerals are privately owned). Governments around the world typically own their country’s minerals. In the U.S., private citizens/mineral owners have the right to buy, develop, lease, bequeath and sell their interests. Mineral owners may realize substantial monetary gains from producing properties in two separate and different ways. The first comes in the form of lease bonuses. A lease bonus is an upfront cash bonus paid by an operator to the mineral owner for the right to develop the acreage. The second revenue source, which is royalty payments, resulting from the development by an operator of producing wells on the leasehold. Combined, lease bonuses and royalty payments can create substantial revenue from the production of oil and gas. In addition, the revenue from production is paid to mineral owners before any expenses are deducted. Perhaps most importantly, mineral rights never expire. Mineral interest purchase, ownership, management, and disposition are parts of a real estate transaction. Mineral rights ownership, as it relates to oil and gas, began to take shape and gain financial importance in 1859 with the drilling of the first commercial oil well in the U.S. by Colonel Edwin Drake. Mineral rights can be severed, or separated from, the surface rights to the land. A surface rights owner has air rights over the land and from the surface down to “plow-depth.” Below that, the mineral owner’s rights take over. Public and private oil companies are always in search of -- and pay substantial bonus premiums for -- lands to lease that may provide oil and gas production once developed. Competition is fierce for the minerals underlying good producing properties, or those which are “ahead of the drill bit.” As I have mentioned, lease bonuses are upfront lump sum cash payments per acre to the mineral owner for the right to drill for oil and gas, PLUS there are royalty checks from producing properties. In addition to the lucrative lease bonuses, owners can get from 12.5 to 25 percent of gross revenues generated from production. On top of that, mineral owners incur no expenses for any drilling, completion, operations or dry-hole costs as one would on a drilling and development investment, making for a compelling investment opportunity. An article in the Wall Street Journal, “Mineral Rights Can Make You Rich” touted a 2013 study supporting that private mineral rights owners in 2012 earned $22 billion dollars in royalties. Often more familiar to, and more often owned by institutional investors, mineral rights should also be an investment consideration for qualified private individuals given low risk and high potential reward with proper execution.

At Redhawk Investment Group, we have decades of experience developing and managing oil and gas investments. This fall, we’re offering accredited investors the opportunity to invest in our Redhawk Minerals Fund II, LP. This fund, with mineral rights strategically located in Oklahoma’s high-producing STACK play, is projected to be a $30 million dollar fund with an average annual target yield of 20 percent plus. Curious to learn more about mineral rights and how you could make money from ownership? Get in touch with us. The material herein does not constitute an offer to see nor is it a solicitation of an offer to purchase any security. Offers will only be made through a private placement memorandum to accredited investors and where permitted by law. Investments in security are not suitable for all investors who can withstand the loss of their investment. Investors should perform their own investigations before considering any investments and consult with their own legal and tax advisors. Past performance does not guarantee future results. This presentation is copyrighted material and only for the use by Redhawk Investment Group and its affiliates.

2 Comments

|

Archives

October 2018

Click here to view our Offerings |

Hours: M - F 8:00 a.m. - 5:00 p.m. CentralTelephone: 214-624-9867Email: jnichols@peqtx.com |

Quotes by TradingView

|

Redhawk Investment Group, LLC offers direct and alternative oil and gas investment opportunities that enable investors to participate in the potential cash flow and the unique tax benefits associated with oil and gas investments. There are significant risks associated with investing in oil and gas offerings. The information contained in this website is for informational purposes only and is not a solicitation to buy or sell any securities. Information on this site is not intended to be used as investment or tax advice. Consult your investment advisor or tax advisor concerning the current tax laws and effects on your personal tax situation.