|

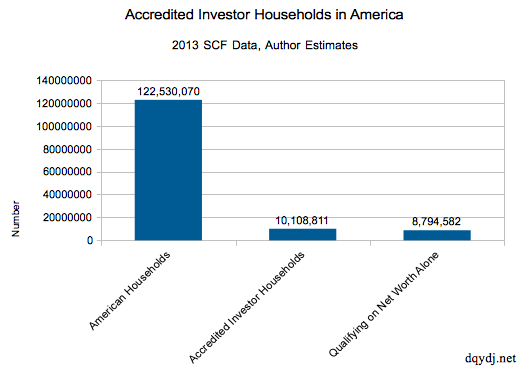

Investors hear the term “accredited investor” bantered about often. Being a qualified or “accredited investor” can open doors to many higher yielding – though often higher-risk –investment vehicles. For the independent-minded investor who is not typically attracted to large institutional “plays” sponsored by Wall-Street-type firms, understanding what an accredited investor is and how to qualify to become one is an important first step toward building wealth. What is an Accredited Investor? It is estimated that about 8.25 percent of all American households qualify as accredited investors. That is over 10.1 million U.S. households. Further, these households account for over 70 percent of all private wealth in the country or about $45.5 trillion. The term “Accredited Investor” was created by the Securities Act of 1933 and was further defined by 1982 and 1988 changes in Regulation D Rules. These rules were originally conceived for the “protection of investors” and established three basic criteria for being considered accredited:

Why Become an Accredited Investor? As an accredited investor, you are among the top 8.25 percent of financially-qualified individuals in the U.S., which puts you in a fairly elite “club.” It is estimated that the U.S. is currently adding about 1,700 newly accredited individuals per day. By joining this club, you will have more opportunities to directly invest money into a variety of investment vehicles. How to Find Good Investments as an Accredited Investor? Since no formal institution determines accreditation of an investor, the trick becomes understanding the process of verifying your accredited investor status and how to find good investments as an accredited investor. Stepping out of traditional stocks, bonds and ETFs, the road can get a bit complex. Being elevated to a new financial plateau by becoming accredited also comes with its own set of issues. Do you seek out a hedge fund, a venture capital fund, or a private equity fund, only to find minimum investment amounts of $1 million or more that disqualify you quickly? We recommend visiting fund offerings like Redhawk and asking for more information about potential investment offerings. Our qualified staff can help you determine your next steps and provide expert advice and resources about investing. Options for Increasing Returns as an Accredited Investor The most common type of ownership sought by accredited -- but non-super-rich -- investors are equity interests in companies or investment funds. These could include startup companies, private real estate partnerships, oil and gas or mineral development partnerships, and many more. Accredited investors looking for better returns can also explore simple investment vehicles like a “private placement” platform. A private placement is a private capital raising event offered to a relatively small number of investors. It is different from a public offering in which securities are made available to the open market to accredited and non-accredited investors. They are subject to the Securities Act of 1933 and therefore are required to make certain disclosures, but they do not have to be registered with the SEC. Finally, oil and gas partnerships are always a viable option, as they are capital-intensive and offer good tax deductions and very favorable return capabilities. Do Your Due Diligence Often who you are dealing with is as important as where you are developing. The accredited investor will find venture capital opportunities, telecommunications companies, construction companies, shipping and aviation businesses, and the list goes on. Do your homework and exercise due diligence to protect your investment portfolio. We recommend that you consider taking the time when you're making the investment to go see the offices and meet the owners of the companies offering these opportunities. The less credible and “not-so-real” players may not want you to see their physical space or meet the staff that will be managing your investment. Making the Most of Your Investments It’s a brave new world out there. Take your time and think through your investment objectives. Make money. And as always, reach out to our team at Redhawk Investment Group if you have any questions about the process that we can help you with. Jack Nichols Managing Partner Redhawk Investment Group Dallas, Texas www.redhawkinvestmentgroup.com [email protected] Jack Nichols is a founder and Managing Partner of Redhawk Investment Group, a family-owned and operated energy company with offices in Dallas, Texas and Oklahoma City, Oklahoma. The company developed and uses an investor-friendly business model for use in the private placements of mineral rights aggregations and drilling and development projects.

The material herein does not constitute an offer to see nor is it a solicitation of an offer to purchase any security. Offers will only be made through a private placement memorandum to accredited investors and where permitted by law. Investments in security are not suitable for all investors who can withstand the loss of their investment. Investors should perform their own investigations before considering any investments and consult with their own legal and tax advisors. Past performance does not guarantee future results. This presentation is copyrighted material and only for the use by Redhawk Investment Group and its affiliates.

0 Comments

Your comment will be posted after it is approved.

Leave a Reply. |

Archives

October 2018

Click here to view our Offerings |

Hours: M - F 8:00 a.m. - 5:00 p.m. CentralTelephone: 214-624-9867Email: jnichols@peqtx.com |

Quotes by TradingView

|

Redhawk Investment Group, LLC offers direct and alternative oil and gas investment opportunities that enable investors to participate in the potential cash flow and the unique tax benefits associated with oil and gas investments. There are significant risks associated with investing in oil and gas offerings. The information contained in this website is for informational purposes only and is not a solicitation to buy or sell any securities. Information on this site is not intended to be used as investment or tax advice. Consult your investment advisor or tax advisor concerning the current tax laws and effects on your personal tax situation.